Support for Sustainability Assessment

GRESB(http://gresb.com/), the Global ESG Benchmark for Real Assets, is an annual benchmarking assessment to measure the ESG integration of owners and asset managers for real assets (real estate and infrastructure) and funds. We provide comprehensive support for GRESB participation and results analysis.

For more information on GRESB, please click here.

Our Strengths

We have been promoting GRESB in the Japanese market since 2011 and are the designated Premier Partner for Japan.

As active members of various GRESB committees and working groups, we stay informed about assessment criteria developments and relay relevant information between GRESB and the Japanese market.

This expertise and our long-standing relationship with GRESB allow us to provide precise support for accurate reporting and score improvement.

Our Consulting Services

Participation Support

We offer one-stop services for GRESB participation, providing tools and guidance to over 100 companies annually, including J-REITs, private REITs, private funds, real estate developers, and infrastructure companies. Our support includes:

-

●Japanese-language survey forms, reference guides*, response tools, and webinars*

●Advice for your responses and consistency checks

●Pre-submission score calculations*

-

●Translation of responses into English and online input

●Assistance during the Validation and the Review Period

*For Real Estate only

Response Analysis

We analyze your GRESB Assessment results, comparing them with other participants in Japan.

Our detailed and easy-to-read reports in Japanese summarize your response data and highlight trends in various aspects and indicators. We also identify potential issues for the following year, estimate score improvement, and suggest future initiatives. (For Real Estate only.)

Provisional Response Analysis (Gap Analysis)

For companies considering GRESB participation, we offer a provisional response analysis. This service calculates your potential score and identifies areas for improvement based on a hypothetical participation in the most recent Assessment. This service is useful not only for gathering information from your company and relevant business partners prior to participation, but also for expanding your initiatives in anticipation of participation.

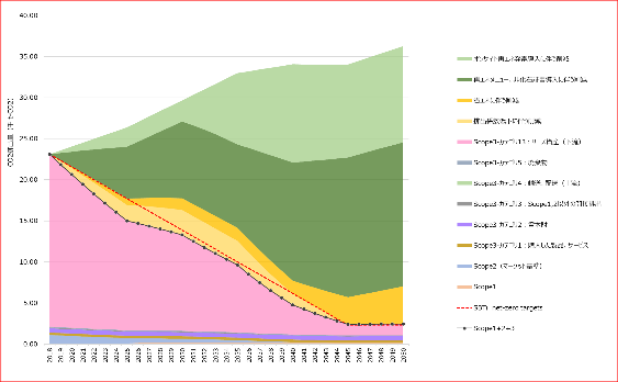

CDP, an international NGO that promotes corporate environmental disclosure, introduced an integrated questionnaire in 2024. This requires responses covering three themes – Climate Change, Water Security, and Forests – combined into a single submission. This approach aims to strengthen responses to various environmental issues and enhance disclosure, with a focus on simultaneously addressing and considering both climate and nature-related challenges.

Furthermore, new questions are added in response to international trends and investor demands concerning climate change and nature. This includes, for instance, incorporating biodiversity-related questions into the Climate Change in 2022 and plastics-related questions into the Water Security in 2023. In 2026, ocean-related questions will be added as a new environmental theme. Furthermore, from 2024, the questionnaire has been revised to reference various standards, including the International Sustainability Standards Board's (ISSB) climate-related disclosure standard (IFRS S2).

Both the number of companies requested by CDP and the number of those disclosing have increased. Following the expansion of the Climate Change questionnaire to include all companies on the Tokyo Stock Exchange Prime Market in 2022, the Water Security questionnaire coverage further expanded in 2023. A similar trend is observed in the real estate and infrastructure sectors, which are considered to have relatively high impact on climate change, water, and deforestation. Even in the J-REIT sector, which is outside the scope of the TSE Prime Market, disclosure requests on Climate Change significantly expanded from 2023 and on Water Security from 2024. As of 2025, nearly 50 investment corporations are covered, with over half responding. Furthermore, regarding the financial sector, scores for Water Security and Forests – not just Climate Change – are now publicly disclosed, leading to an increase in the number of disclosing companies accordingly.

Our Strengths

As well as being a CDP scoring partner for Climate Change, Forests, and Water Security from 2021 to 2023, we are also an Accredited Solutions Provider (ASP) for Climate Change, Water and Forests consultancy in 2025 and 2026. In this context, we have accumulated practical expertise in crafting responses based on our scoring experience and knowledge of the questionnaires. We also conduct in-depth communication and discussions with CDP Worldwide-Japan.

Additionally, alongside supporting sustainability disclosure, we are strengthening our services related to climate change and natural capital initiatives, such as risk analysis and support for transition planning. Furthermore, through activities such as serving as the Japanese secretariat for the Partnership for Carbon Accounting Financials (PCAF), we are also gathering information on various disclosure frameworks. Based on these insights, we provide specialized CDP response support to companies across sectors including real estate, infrastructure, and financial services.

Our Track Record

Our company assists a large number of corporate clients with their responses each year. Since becoming a scoring partner in 2021, every company we have supported has achieved a score of B or higher. Approximately half of these companies have earned an A score for Climate Change, and all companies have achieved an A- or higher for Water Security. Furthermore, among companies with room for improvement, approximately half achieved a higher score than the previous year, while the other half maintained their previous score. In every case, our support ensured they achieved the maximum possible score relative to their current sustainability initiatives. Especially for companies that previously submitted responses by themselves, our support has led to improved evaluations.

Our Consulting Services

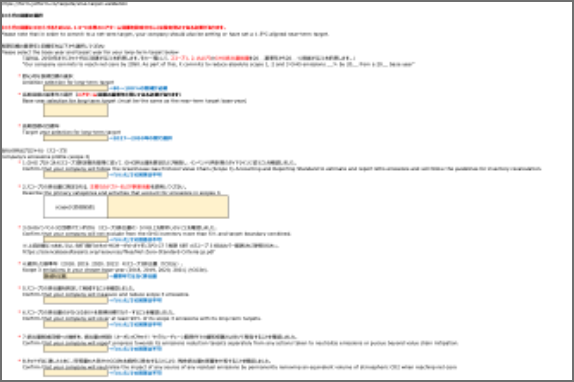

Preparation Support

Our consulting services include CDP reporting preparation for the following year, guiding companies typically from autumn through winter by providing in-depth explanations of the CDP questionnaires, response tools, and comprehensive advice. We also provide guidance on open-ended questions. Once the provisional response is finalized, we estimate scores and identify areas for improvement.

Response Support and Follow-ups

We provide comprehensive, one-stop services to companies responding to the CDP questionnaire, assisting with administrative procedures, updating questionnaire changes, providing response tools, conducting mock-scoring.

We also offer Results Analysis services after the CDP submission, either before or after score publication, which include question-level analysis, score estimation (in cases where scores have not yet been released), advice on improvement strategies, and simulation of possible score increases.

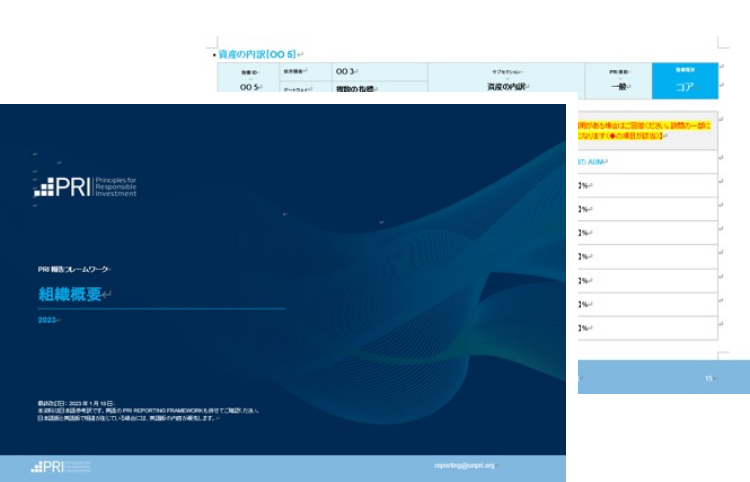

The Principles for Responsible Investment (PRI) was established in 2006 by former United Nations Secretary-General Kofi Annan alongside the United Nations Environment Programme Finance Initiative (UNEP FI) and the United Nations Global Compact. PRI sets the following six principles for responsible investment. These principles include the integration of Environmental, Social, and Governance (ESG) issues into the investment decision-making process to promote a long-term sustainable international financial system.

Investors may become PRI signatories by demonstrating their commitment to the Principles, and are required to report annually on their responsible investment (RI, so-called ESG investment) practices.

The six Principles for Responsible Investment

- We will incorporate ESG issues into investment analysis and decision-making processes.

- We will be active owners and incorporate ESG issues into our ownership policies and practices.

- We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- We will promote acceptance and implementation of the Principles within the investment industry.

- We will work together to enhance our effectiveness in implementing the Principles.

- We will each report on our activities and progress towards implementing the Principles.

Our Strengths

As a PRI signatory since 2012, we have led PRI Japan real estate and infrastructure working groups and currently serve on the Real Estate Advisory Committee and Japan Advisory Committee. With deep ESG expertise across real estate, infrastructure, asset owner, and financial sectors, we provide comprehensive support to signatory institutions when preparing their annual PRI reporting.

Our Consulting Services

Annual PRI Reporting Preparation

We provide the following one-stop services for PRI signatories:

・Explanation of the annual reporting and response process

・Japanese version of the response sheet

・Advice on the responses and consistency check

・English translation of responses and online submission

MSCI publishes ESG indexes, such as the MSCI Japan ESG Select Leaders Index, which lists selected companies that excel in ESG based on the MSCI ESG Ratings. In a world where ESG assessments are factored into the investment process, such assessments are becoming more important than ever.

Our Strengths

We offer expert advice to issuers on improving their ESG Ratings and analysis of the performance of their industry peers, drawing on our extensive sustainability expertise in the real estate and infrastructure sectors.

Our Consulting Services

Analysis of Current Assessment

We compare your ESG Ratings Report with your existing initiatives and disclosed information to identify areas where improvements can be made. This analysis includes benchmarking against the J-REIT sector or the wider real estate sector.

Strategic Disclosure Advice

We provide guidance on enhancing your disclosures to boost MSCI Ratings, offering advices on structure, content, and wording, as well as reviewing your drafts.

Proactive Feedback Support

We provide support for compiling feedback drafts for the MSCI Issuer Portal to ensure your ESG disclosures are more accurately assessed. We track the results and provide ongoing support to enhance your Ratings.