Support in Improving ESG Assessment

GRESB(http://gresb.com/), is an annual benchmarking assessment to measure Environment, Social and Governance (ESG) integration of companies and funds developing, owning or managing real assets (real estate and infrastructure), and the name of its governing body. We provide support for GRESB participation and results analysis services to companies in the real estate and infrastructure sectors.

For more information on GRESB, please click here.

Our Strengths

We have been officially promoting GRESB in the Japanese market since 2011, and is designated as the recommended Premier Partner for Japan.

While participating as a member of various committees and working groups of the GRESB Foundation, which develops the assessment criteria, we actively communicate relevant information in Japan to the GRESB and gather information on the future direction of development.

With the knowledge we have gained and data accumulated since the early days of the GRESB and our close communication with the GRESB, we provide accurate support to participants for accurate reporting and score improvement.

Examples of Our Consulting Services

Participation Support

We offer the following one-stop services for your participation in the GRESB.

Since GRESB's published materials and information are basically only available in English, we have developed tools to support Japanese-language and support more than 100 companies in the real estate and infrastructure sectors (J-REITs, private REITs, private funds, real estate developers, infrastructure companies, etc.) every year.

-

●Provision of Japanese-language survey forms, reference guides*, response tools, and webinars*

●Advice for your responses and consistency check

●Calculation of expected score based on your responses prior to submission to GRESB*

-

●Translation of responses into English and online entry of responses

●Support in responding to the Validation and the Review Period

*For Real Estate only

Response Analysis

We will analyze the assessment results of your responses you submitted in comparison to other participants in Japan.

GRESB also provides an assessment report for each individual company, but we provide a more detailed and easy-to-read report in Japanese that summarizes your company's response data in addition to the trends of other companies' responses in various aspects and indicators.

In addition, we also categorize issues that are expected to arise in the following year, estimate score improvement, and propose the direction of your future initiatives. (For Real Estate only)

Provisional Response Analysis (Gap Analysis)

For those companies considering participation in the GRESB, we offer a "provisional response analysis" in which we calculate your score and analyze the potential for improvement based on your responses, assuming that you had participated in the most recent assessment. This service is useful not only for gathering information from your company and relevant business partners prior to participation, but also for expanding your initiatives in anticipation of participation.

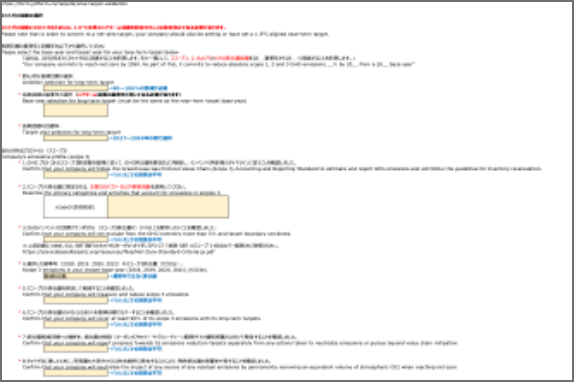

CDP, an international NGO that promotes corporate disclosure of environmental information, in its five-year strategy "Accelerating the rate of change" from 2021 to 2025, has clarified that by 2025 it will expand the scope of disclosure in the environmental sector from the existing "climate change," "water security" and "deforestation" to "biodiversity," "ocean," "land use," "food production" and "waste".

Based on this, new questions are added to the CDP questionnaires every year in response to international trends and investor requests regarding climate change and the natural environment, such as the inclusion of biodiversity-related questions in the Climate Change 2022 Questionnaire and plastics-related questions in the Water Security 2023 Questionnaire. Furthermore, the International Sustainability Standards Board (ISSB) climate-related disclosure standards (IFRS S2) will be incorporated into the CDP questionnaire in 2024, accelerating the expansion of sustainability-related disclosures on a global basis.

The number of companies surveyed has also increased: in 2022, the companies requested to respond to the CDP Climate Change Questionnaire were expanded to include all Tokyo Stock Exchange Prime Market companies. In 2023, those for the CDP Water Security Questionnaire were also expanded.

The conventional three questionnaires that cover climate change, water security, and forests will be integrated starting in 2024, which will further increase the need for action and information disclosure on various environmental issues, with simultaneous resolution of the towoe issues of climate and nature and consideration of both in mind. The real estate and infrastructure sectors, which are considered to have a relatively high impact on climate change, water, and deforestation, are no exception, and it is expected that more emphasis will be placed on the disclosure of such environmental information and that disclosure requirements from all stakeholders will increase.

Our Strengths

We have been a scoring partner of CDP in the climate change, forest and water (only for 2023) areas since 2021, and have expertise in preparing responses based on our knowledge of the CDP questionnaire and scoring experience. In addition to supporting ESG information disclosure, including TCFD compliance, we also focus on services pertaining to climate change-related initiatives, such as climate change risk analysis and support for obtaining SBTi certification, as well as participating in the TNFD Forum to gather information on the TNFD disclosure framework. With this knowledge, we support real estate and infrastructure companies in responding to CDP questionnaires.

Examples of Our Consulting Services

Support in Preparing Responses

For companies that will start responding to the CDP questionnaires in the coming year or later, we provide a one-stop support service from summer to winter every year to help them prepare responses. Specifically, we provide an overview of the questions, response tools for use when preparing responses and answering questions, and advice, etc. In particular, with regard to the climate change questionnaire, we can propose a response framework for some open-ended questions, support in compiling numeric data, estimate the expected score at a certain point, and identify issues to be improved.

Support for Responses and Follow-up after Results are Released

For companies that respond to the CDP questionnaires, we provide one-stop consulting services to prepare for the submission of responses, including support for administrative procedures between CDP and your company, explanation of the question outline and changes from the previous year, provision of response tools for use when preparing responses and answering questions, and advice. We also explain how to read the CDP Score Report (English), which will be issued after score release.

For the Climate Change Questionnaire, we also provide an analysis report service either before or after the score release after submission of responses, which includes the identification of issues at the question level, calculation of the expected score (before release), advice on your activities, and simulation of the expected score after addressing the issues.

The PRI (Principles for Responsible Investment) was proposed by former United Nations Secretary-General Kofi Annan and established in 2006 as an investor initiative in conjunction with the United Nations Environment Programme Finance Initiative (UNEP FI) and the United Nations Global Compact, and sets forth six principles for responsible investment. The principles include the integration of Environmental, Social, and Governance (ESG) issues into the investment decision-making process in order to achieve a long-term sustainable international financial system.

Investors may become PRI signatories by demonstrating their commitment to the Principles, and are required to submit an annual report on their responsible investment (RI, so-called ESG investment) practices every year.

The six Principles for Responsible Investment

- We will incorporate ESG issues into investment analysis and decision-making processes.

- We will be active owners and incorporate ESG issues into our ownership policies and practices.

- We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- We will promote acceptance and implementation of the Principles within the investment industry.

- We will work together to enhance our effectiveness in implementing the Principles.

- We will each report on our activities and progress towards implementing the Principles.

Our Strengths

Since we became the PRI signatory in 2012, we created and chaired working groups for both real estate and infrastructure of PRI Japan. Currently, we are the members of Real Estate Advisory Committee and Japan Advisory Committee, and based on our accumulated ESG knowledge in the real estate and infrastructure sectors, as well as in the asset owner and financial sectors, we provide comprehensive support to signatory institutions in preparation for the annual report described above.

Examples of Our Consulting Services

Support in Preparing for an Annual PRI Report

We provide the following one-stop services for PRI signatories in conducting their annual reports.

・Explanation of an overview of the annual report and the response process

・Provision of a Japanese version of the response sheet

・Advice on the responses and consistency check

・English translation of responses and online input on behalf of signatory institutions

MSCI publishes the the ESG indexes, such as MSCI Japan ESG Select Leaders Index, which is composed of selected companies that excel in ESG based on the MSCI ESG Ratings. In addition, the trend to take ESG ratings into account as part of the investment process has become widespread in recent years, and the importance of ESG ratings is expected to continue to increase in the future.

Our Strengths

We provide issuers with advice on how to improve their ratings, and analyze the ratings of their competitors, leveraging our accumulated ESG expertise in the real estate and infrastructure sectors, and using data we purchase from MSCI.

Examples of Our Consulting Services

Analysis of Current Assessment

Regarding the assessment in each issuer's ESG ratings report, we compare the current assessment with your existing and ongoing initiatives and disclosed information to identify areas where improvements can be made. For this purpose, we perform an analysis by comparing the current assessment results with those in the J-REIT and real estate sectors

Advice on Disclosure to Improve Ratings

We provide advice on the content of disclosures that should be enhanced in order to improve the MSCI ratings. Specifically, we offer advice on structure and items, content and wording, and review of your company's drafts.

Support for Feedback

We provide support for providing feedback to MSCI so that the status of ESG disclosure is more accurately reflected in the assessment. Specifically, we will prepare a feedback draft regarding the assessment posted on the MSCI Issuer Portal and finalize it after consulting with you. We will also follow up on the results of the feedback.